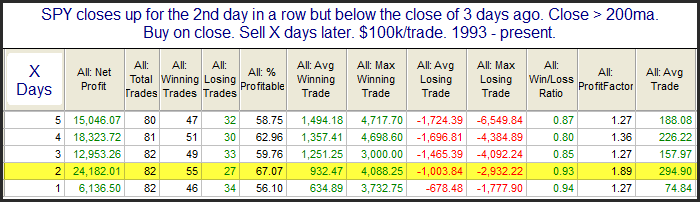

The studies below appeared in the Quantifinder yesterday and the Gold Subscriber Letter last night. The first one looked at times the SPY bounced up 2 days in a row but still failed to close above the close of 3 days ago.

The stats suggest a moderate upside edge over the 1st 2 days.

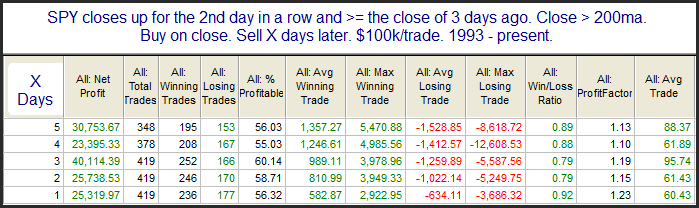

To see the importance of the “close < 3 days ago” filter let’s also examine those times when the 2-day rally was strong enough to close above the close of 3 days ago. Those results are below.

As you can see, that small change makes a big difference. Two days out total gains are about the same despite the fact that there are about 5 times as many instances.

Of course today is a Fed Day…

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.