The study below considers the extremely low reading in the TICK TomOscillator. The TICK TomOscillator is an indicator that uses recent closing TICK values to determine buying and selling interest at the end of the day. It was developed by Tom McClellan. I’ve done some work with it and the name I use is one I made up. For those who would like to learn more about the TICK TomOscillator, the link below is a good place to start.

https://quantifiableedges.blogspot.com/2011/05/how-nyse-closing-tick-can-be-utilized.html

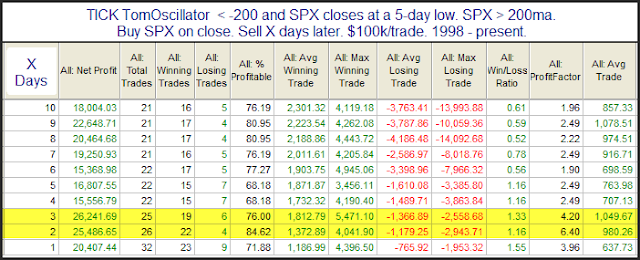

The study below looks for an extremely low reading in conjunction with a short-term oversold price condition during a long-term uptrend. It has been shown in the subscriber letter before and triggered again at Tuesday’s close.

There has been a strong propensity for the market to bounce over the next 2-3 days.