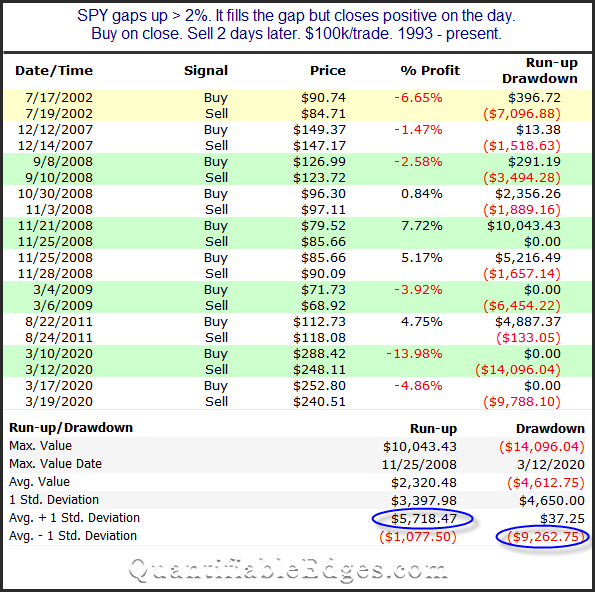

It was unusual on Friday to see such large opening gap (+2.54%) filled, and then SPY still managed to close positive. This can be seen in the study below, which I showed in the subscriber letter over the weekend.

Four instances closed higher, and 6 closed lower over the next 2 days. So there does not appear to be a strong directional bias. But the takeaway is that the volatility did not just disappear. At the bottom you’ll see I circled stats looking at avg “run-up + 1 standard deviation” and avg drawdown – 1 std deviation”. What those mean is that it would not be unusual to see the market rise as much as 6% or decline as much as 9% over the next couple of days. That is a huge spread for a 2-day time span. It speaks to the potential risk of being wrong.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?