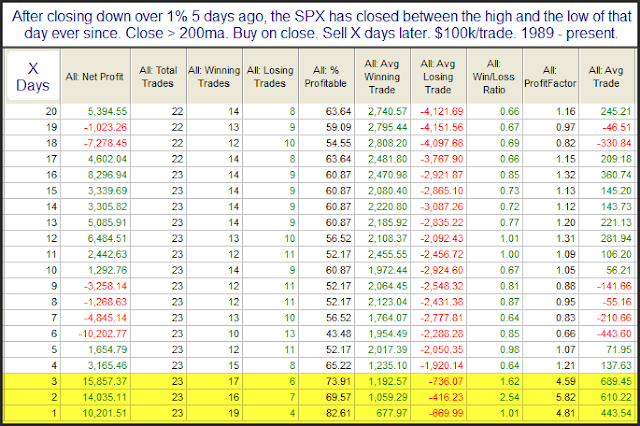

The market has been stuck in a trading range for the last couple of weeks, and that range has tightened even further in the last week. Looking at the SPX we have now seen 5 closes in a row that have occurred within the range of the 3/1/11 bar. Inspired by some gap-related research by Scott Andrews over at Master the Gap using a similar setup, I decided to take a more detailed look at this set of circumstances. What stuck out to me is that 1) the SPX has been in a long-term uptrend. 2) There was a sizable 1-day selloff. 3) The bears failed to follow through on that selloff, yet the bulls have not managed to move the SPX back out of the range either.

Over the last 22 years or so the SPX has burst higher out of this “failed selloff” and consolidation on a consistent basis. But the implications are only bullish for a few short days. After that there does not appear to be a decided edge for either the bulls or the bears.