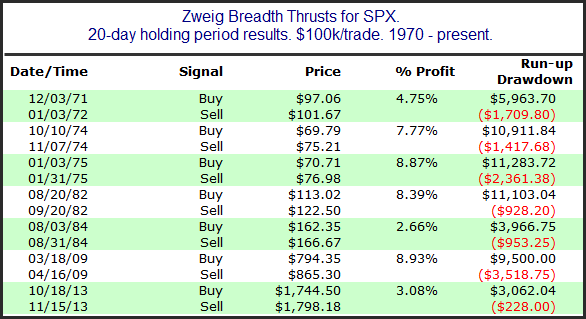

The strong breadth we have seen recently has caused the 10-day exponential moving average of the Up Issues % to rise up over 63%. A move through 61.5% after being below 40% within the last 2 weeks is considered a Zweig Breadth Thrust trigger. This is a signal created by Martin Zweig. Over the long haul it has been a rare but powerful signal. It triggered at the close on Thursday. Below is a list of all of the signals since 1970 along with their 4 week results.

Every instance has closed higher 20 days later. (And 19 and 18 and 17 and 16 and 15 and 14 and 13.) All 7 instances saw a runup of at least 3% over the next 4 weeks, and only once did the market pull back as much as even 2.5%. It will be interesting to see how this one plays out, but traders may want to keep it in mind over the next few weeks.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.