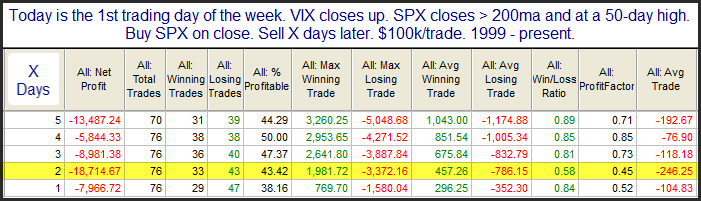

While the SPX closed up the VIX also rose. Most often they trade opposite each other, so this kind of action is somewhat unusual. But VIX has a tendency to decline going into the weekend (Friday afternoons), and then rise when it returns from the weekend. So to see this action on the first trading day of the week is less unusual than at any other time. Still, combined with the SPX 50-day high, it has often been followed by a dip in the next few days. This can be seen in the study below, which appeared in Monday’s Quantifinder.

Results here appear somewhat bearish over the 1st 1-2 days, and suggest a brief pullback is likely. But I am also seeing evidence that the persistent move up to new highs reduces the probability of a substantial selloff in the near-term. So while there appears to be a possible short-term downside edge based on the study above, I don’t view the current setup as very compelling for shorts. This is something I discussed in more detail in last night’s subscriber letter. (Click here for a free trial.)

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

Learn how to identify edges and formulate swing trading strategies in the new Quant Edges Swing Trading Course!