On Friday I introduced the QE Buying Power Index and showed results over the 2008-2011 period when looking to buy pullbacks with a strong QE Buying Power Index reading versus a weak one. Today I’ll show the other side of the coin. Below is a short-side version of the same swing trade system. On Friday the system I used to demonstrate the importance of buying power simply bought the SPX when it closed in the bottom 20% of the 10-day range and then sold it when it closed back in the top half. Today we’ll look at shorting closes in the top 20% of the range and covering in the bottom half.

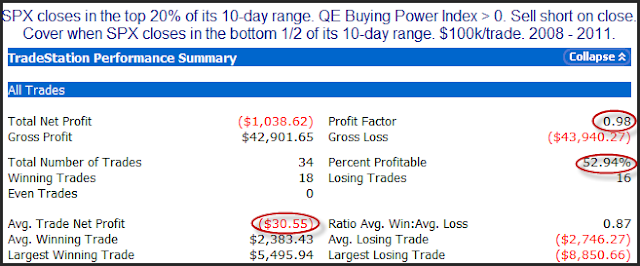

First let’s look at times when the QE Buying Power Index was positive.

As you can see, when the QE Buying Power Index has been positive, trying to short overbought market readings has been futile and there has been no edge in doing so.

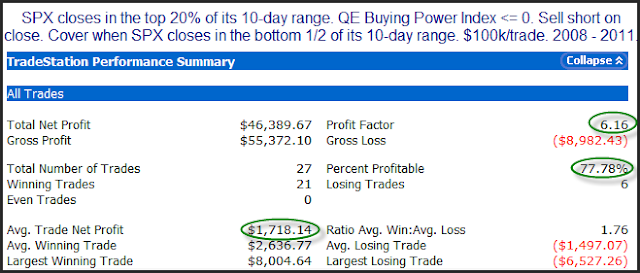

But now let’s examine results when the QE Buying Power Index was NOT positive.

We see here a remarkable difference. Simply taking buying power into consideration changes the results dramatically.

Over the last 4 years buying power has been extremely important in determining market movements. In the special (100% satisfaction guaranteed) webinars later this week I will explain to traders the concept behind the QE Buying Power Index and teach them how to calculate it. I’ll discuss how the it has influenced the intermediate-term over the years and how you can use it to swing trade with a system like those I’ve discussed the last few blog posts.

Click here for more information on the webinars and to register.