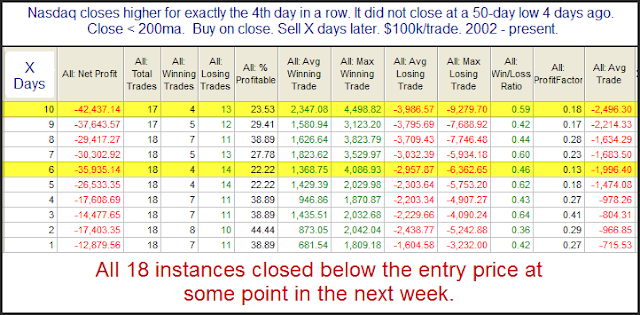

Many people are aware that several higher closes during a downtrend will often suggest a downside edge. Few people realize how strong this tendency has been in the Nasdaq over the last decade, especially once the index has closed up 4 days in a row. With the Nasdaq now up exactly 4 days in a row as of Monday’s close, the study below is triggering.

Not only has the bearish tendency been strong and consistent, but it has persisted for as long as 2 weeks in most cases.

Are you wondering why the 50-day low filter is included? Here’s why:

https://quantifiableedges.blogspot.com/2011/10/why-shorting-in-this-environment-can-be.html