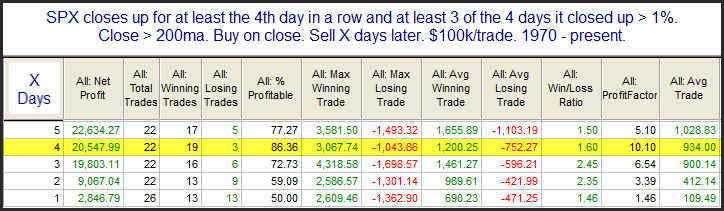

I saw some chatter on Twitter on Thursday about how rare it is to see SPX close up > 1% for 4 days in a row. In fact, when filtering to see times it has occurred since 1970 with SPX closing above the 200ma, there was only one other instance – 10/11/82. But we did have a study in the Quantifinder that looked at strong 4-day win streaks that required at least 3 days close up 1% or more. That gave a better sample size, and can be seen below.

Numbers here are lopsided to the bullish side. The market is certainly short-term overbought, but this study suggests a good chance at becoming more overbought.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?