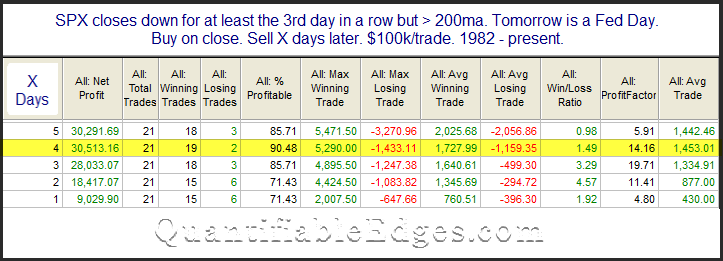

Fed Days often generate compelling studies to consider and share in the nightly subscriber letter. I have also covered them in the blog many times over the years. A Fed Day is one of eight days per year that the Federal Reserve concludes one of their scheduled meetings and makes a policy announcement. Wednesday is a Fed Day. Historically, Fed Days have had a bullish inclination. That inclination has been even stronger when there has been selling heading into the Fed Day. The study below examines other times that SPX was in a long-term uptrend, but closed down for at least the third day in a row going into the Fed Day.

These are some very encouraging numbers for the bulls. Below is the list of instances.

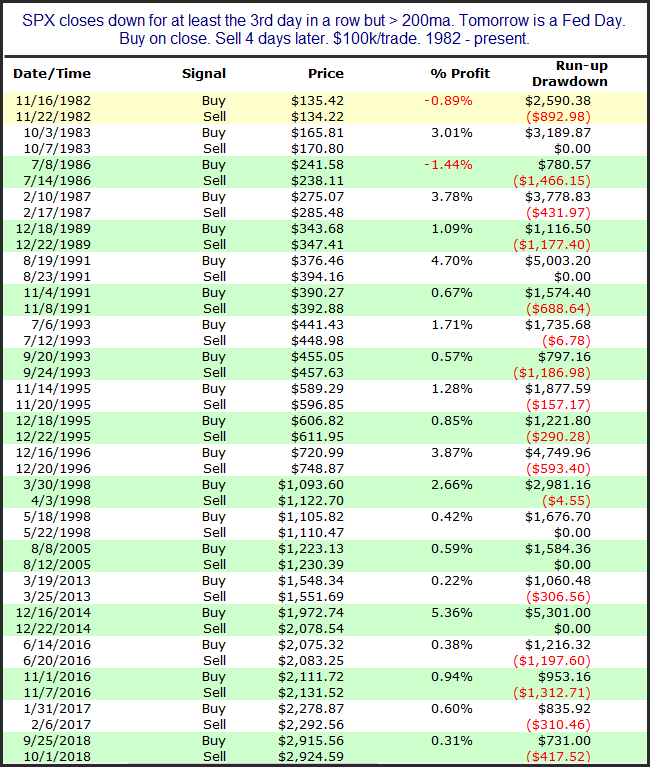

The setup has certainly been potent over a long period of time. There has not been a loser for the 4-day holding period since 1986. And every instance back to 1982 has closed higher than the entry price at some point in the next 4 days. Of course anything can happen when it comes to the market, but evidence here suggests a substantial upside edge over the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?