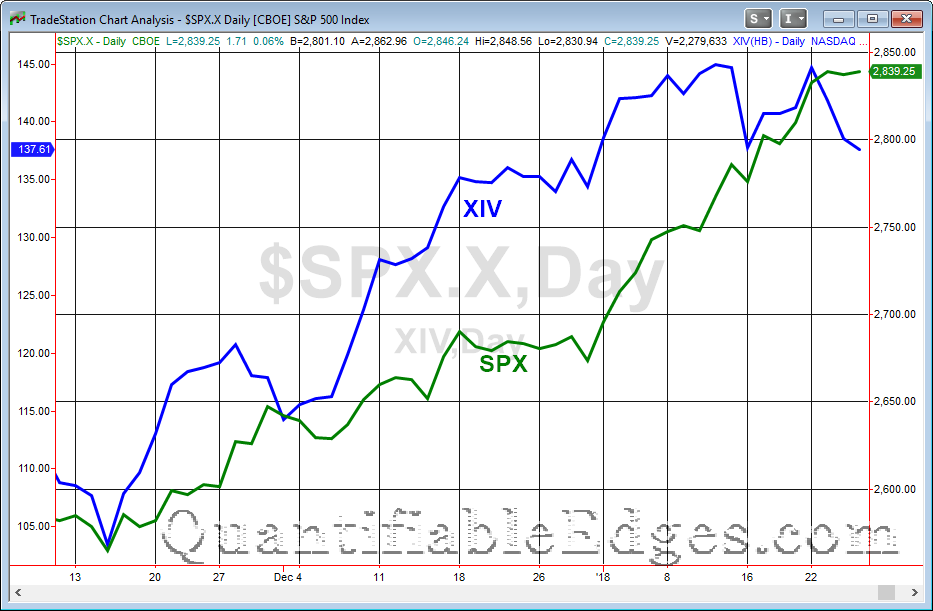

XIV is an inverse-VIX ETN. In other words, it was designed to generally trade inversely to VIX futures on a daily basis. Since VIX and SPX typically trade opposite each other, you would think that XIV and SPX would often close in the same direction. And you would be right. Of course, XIV depends on more than just the movement in the VIX to determine its price. Among other things, it is influenced by short-term VIX futures movement and the term structure of the 1st couple months of VIX futures contracts. This is not the place to get into a deep discussion of XIV price influences. But it is important to understand that it 1) generally trades inverse to VIX movement, and 2) will often trade in the same direction as SPX. XIV has diverged with SPX in recent days. In fact, while SPX closed at an all-time high on Thursday, XIV closed at the lowest level of 2018. This can be seen in the chart below.

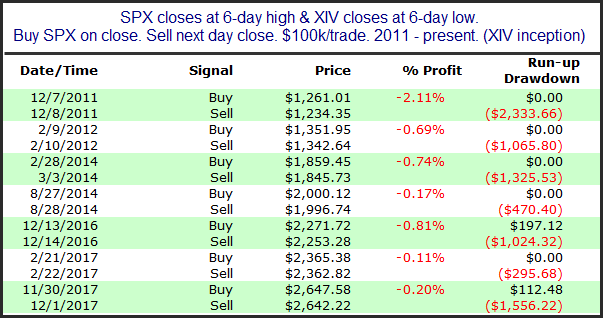

The divergence between the 2 is highly unusual. In fact this is the 1st time ever (since 2011 XIV inception) that SPX has closed at even a 10-day high while XIV has closed at a 10-day low. If we loosen the criteria to only require a 6-day SPX high and a 6-day XIV low we can find 7 previous instances. Their 1-day results can be found below.

The number of instances is low, but early indications suggest a possible 1-day downside edge.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.