I have seen some chat about the Russell “Death Cross” that occurred on Friday and the potential bearish implications for the market. A “Death Cross” is a catchy (though not terribly accurate) term for when the 50-day moving average of a security cross below its 200-day moving average. It is sometimes promoted as a warning of a potential bear market. Of course all bear markets will see this happen at some point, because a bear market is an extended decline. But the real question when considering the implications of the Death Cross are whether it serves any value in predicting a more substantial decline. A few years ago I did an examination of past Russell Death Crosses, and what they meant for the S&P 500. I have updated that study from the 11/14/18 blog below.

Both of my data sources show Russell data back to late 1987. And since I need 200 days to calculate a 200-day moving average, the earliest the study could look back to was 1988.

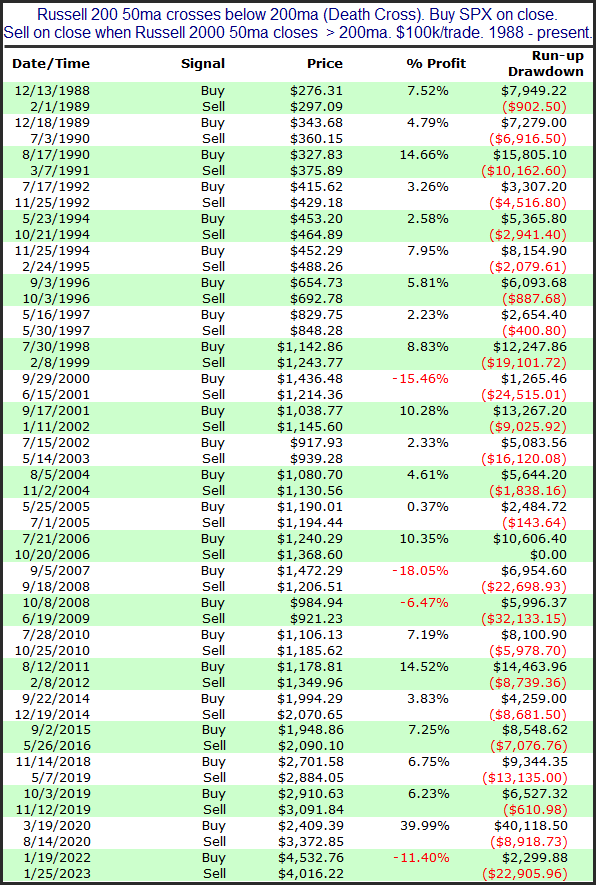

Here is the list of all Russell Death Crosses and how the SPX performed from the time of the initial cross until the Russell Death Cross was no longer in effect (meaning the 50-day moving average closed back above the 200-day moving average).

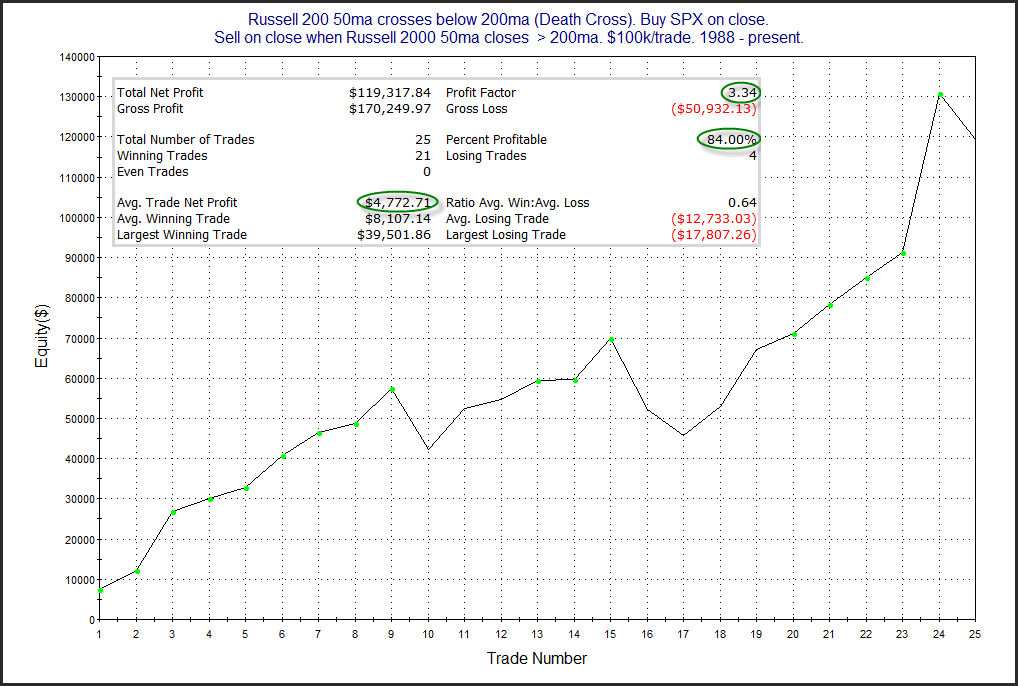

Twenty-one winners. Only four losers. So 84% of the “predictions” were wrong. The biggest winner of the group came in 2020. The most recent instance, from last year, saw a substantial loss. Here is a look at the summary stats and a profit curve for this setup.

I am having a hard time seeing the Russell 2000 Death Cross as a bearish indication. You would have a much easier time convincing me this is a bullish indication for the intermediate-term. (I don’t really view it as bullish though. Drawdowns were generally sizable, even for a good portion of the “winners”.)

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?