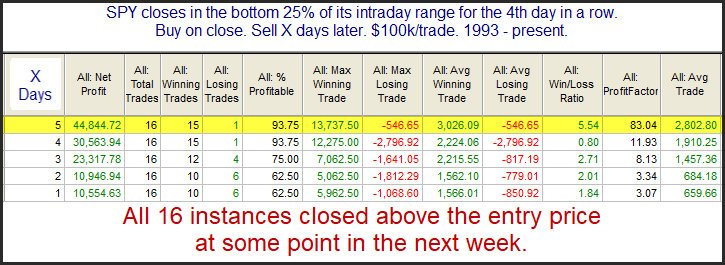

Despite attempts to put in rallies over the last few days, SPY has been persistently weak in the afternoon. It has not managed to hold gains and has closed in the bottom 25% of its daily range for the last 4 days in a row. That may not sound all that extreme, but it is quite rare. Below is a look at how the market has performed following past occurrences. It looks back to the inception of SPY in 1993.

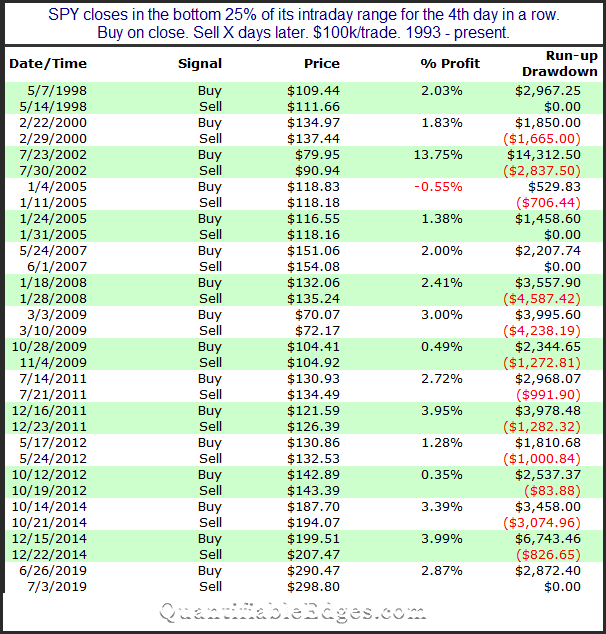

The numbers are very lopsided in favor of the bulls. Below is a list of all instances assuming a 5-day holding period. The bears have owned the afternoons lately. It appears in the next few days the bulls will have their chance, and this study suggests an afternoon that does not go to the bears could turn into a sizable move higher.

I do not see anything here that alarms me. The bears have owned the afternoons lately. It appears in the next few days the bulls may have their chance. This study suggests an afternoon that does not go to the bears could turn into a sizable move higher.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?