A market variable that I rarely see discussed and almost never utilized is Buying Power. And while it has become easily measurable and quantifiable over the last several years, I have found very little information on the concept. In some special webinars next week I will unveil the new QE Buying Power Index. The QE Buying Power Index can be used to help determine whether a reversal or a continuation of a move is likely. Below is a simple swing trading system that demonstrates the value of the QE Buying Power Index.

To see its impact on performance let’s examine a simple swing trading system that looks to buy pullbacks. The pullback approach is very simple. The swing system buys SPX whenever it closes in the bottom 20% of its 10-day range and holds it until it closes in the top half of its (then current) 10-day range. In the performance report below you can see how SPX performed from 2008 – 2011 when pullbacks were bought and the QE Buying Power Index reading was low.

While there were a few more winners, the size of the losers was much higher. Buying pullbacks in this way would have produced more frustration than profits. It was essentially a breakeven strategy over the 4-year period.

But now let’s look at results when the QE Buying Power Index was providing strong readings.

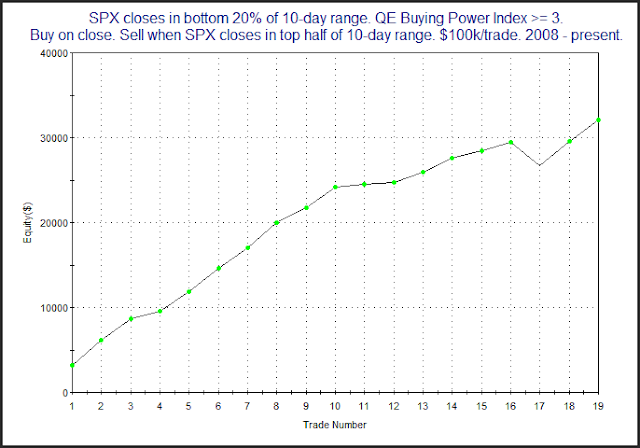

The numbers here are outstanding. With strong buying power present pullbacks provided high probability opportunities. Let’s take a quick look at a profit curve to see how the steady the gains were.

Profit curves don’t get much more appealing than that.

So what is the secret, and how can you compute the QE Buying Power Index yourself? Register for one of the webinars and find out! The cost is only $25.00, and while performance is never guaranteed, your satisfaction with the information presented is – 100%. For more information and to register for an upcoming webinar click here.