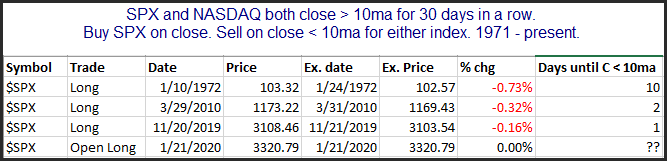

Last week I noted the current rally was reaching historical extremes for persistency. Here I will look at another study from the subscriber letter, and then update last week’s study. In last night’s letter I looked at all times back to the inception of the NASDAQ in 1971 in which both SPX and the NASDAQ Composite closed above their 10ma for at least 30 days in a row. The short list is below.

Only 3 previous instances. And one of those was in the current move higher during November. Of course another way to look at it is how I did last week, in that SPX has only seen 5 closes below the 10ma since October 10th. We have now reached the point where just 5 of the last 70 trading days have closed below the 10ma. Other times where that has happened are 1972 (March), 1965 (Nov), and 1933 (Jul). That is it. And if it reaches 5 out of 71 days on Wednesday, then it is just 1972 and 1933 that you can point to.

Finding short-term trading opportunities in such a market can be difficult. It is tough to find a meaningful historical edge when the market is trading so far beyond historical norms.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.