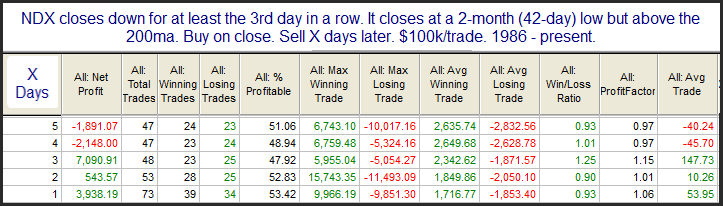

The NDX was hit especially hard last week. It fell 4.5% on the week and Friday was the lowest close since October. Many times we will see multi-day pullbacks and/or intermediate-term lows during a long-term uptrend suggest the market is primed for a bounce. But in running some studies on NDX this weekend, I found results like below.

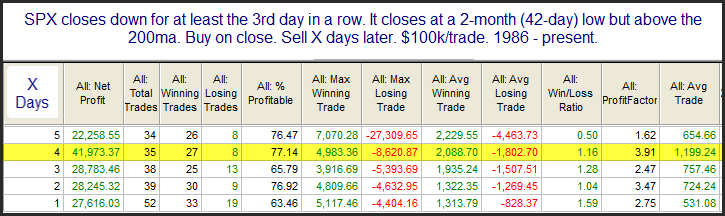

Such setups have been a tossup over the following days. SPX traders might find these results surprising. But SPX and NDX have exhibited somewhat different tendencies over the years. The SPX is more prone to mean reversion than the NDX. NDX tends to trend better. One example of this can be seen by looking at the same study using SPX.

These numbers are quite compelling. Of course, SPX is nowhere near its 2-month low. So this is not setting up.

I will note I am seeing some mild evidence that a bounce is likely in the next few days. But there could be more pain before it happens, as demonstrated by the NDX study and the fact that the SPX isn’t nearly as oversold.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?