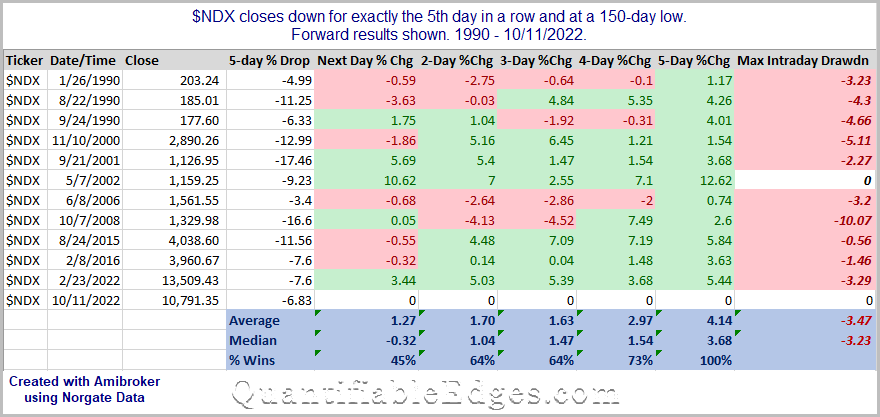

The two big up days to start last week have now been followed by 5 down days in a row. And the 5-day selloff has put the NDX at a new bear-market closing low. The study below looks at other times since 1990 that NDX closed down for the 5th consecutive day and at a 150-day low.

These results suggest an upside tendency. Five days later all 11 instances closed higher, with the average instance up 4.14% and the median up 3.68%. But it is also notable that the gains were not achieved without some short-term pain. The average drawdown of the 11 instances was nearly 3.5%.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?