I’ve shown several times before that when the market is already at a high level and it gaps up large in the mornining there is a quantifiable downside edge for the rest of the day. The large gap up incites profit taking. See the link below for an example:

https://quantifiableedges.blogspot.com/2009/08/large-gaps-up-from-1-month-high.html

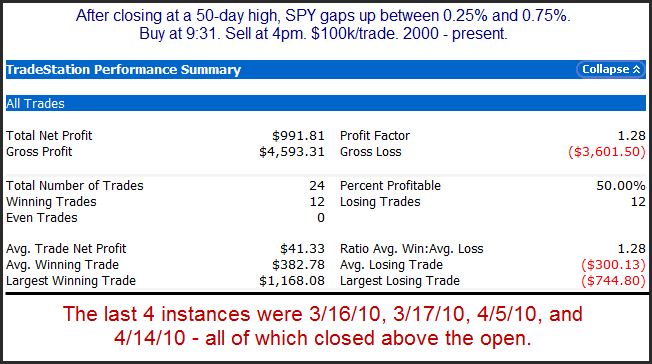

But what of times like now when the makret is at a new high, but the gap up is only modest? Below is one way to look at it.

It appears when the gap up is of a moderate size a downside edge no longer exists. And while a large gap up would have had me excited about shorting this morning, this study suggests no substantial edge at all.