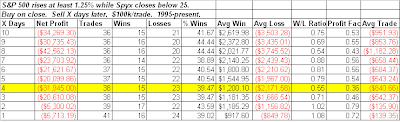

The Quantifiable Edges Volume Spyx indicator came in at a very low 15 reading on Tuesday. In general, very low readings have been bearish while very high readings have been bullish. (For those who are new to the volume Spyx indicator, click here for the introductory post on it.) Below is a study showing returns following all instances where the S&P rose at least 1.25% and the Spyx finished below 25.

(click on table to enlarge)

Most of the bearish tendency plays out within the first 4 days. As a baseline, over the same period the average 4-day return of the S&P 500 following a 1.25% gain with a Spyx reading ABOVE 25 is almost dead even at -$0.13. This is substantially higher than the average -$840.66 decline shown in the study.

An S&P chart with the volume Spyx indicator is updated each night on the Quantifiable Edges Home Page.