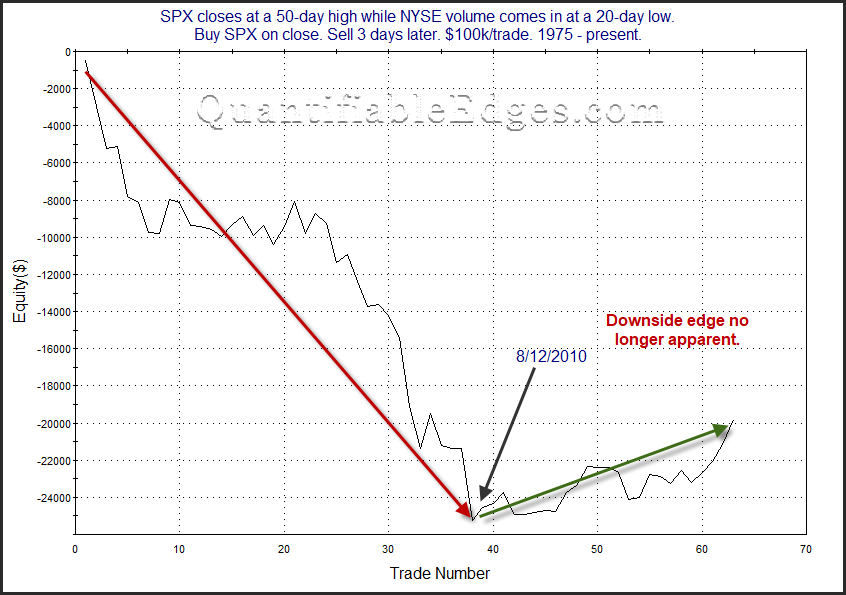

Years ago, strong overbought readings during an uptrend were easily sold – especially when volume came in very light. But that has not held true in recent years. There were several studies I examined last night that noted the low volume, but they have all lost their edge over the last several years. An example can be seen in the chart below, which is representative of the results I was seeing.

Low volume at a new high has not seemed to matter during this decade. Perhaps it is due to such a long and persistent bull market. Perhaps off-exchange volume or increased derivatives trading has changed the importance of NYSE volume. Or maybe the SPX mean-reversion tendency has lessened. But whatever the reason, a new high on low volume does not seem to be a bad omen anymore.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.