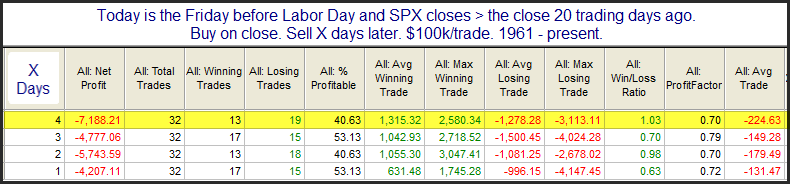

In past years I have shown that Labor Day week performance has often been poor when the market has rallied over the month (20 trading days) leading up to it. Below is a look at Labor Day week performance when the previous 4-week period has seen gains.

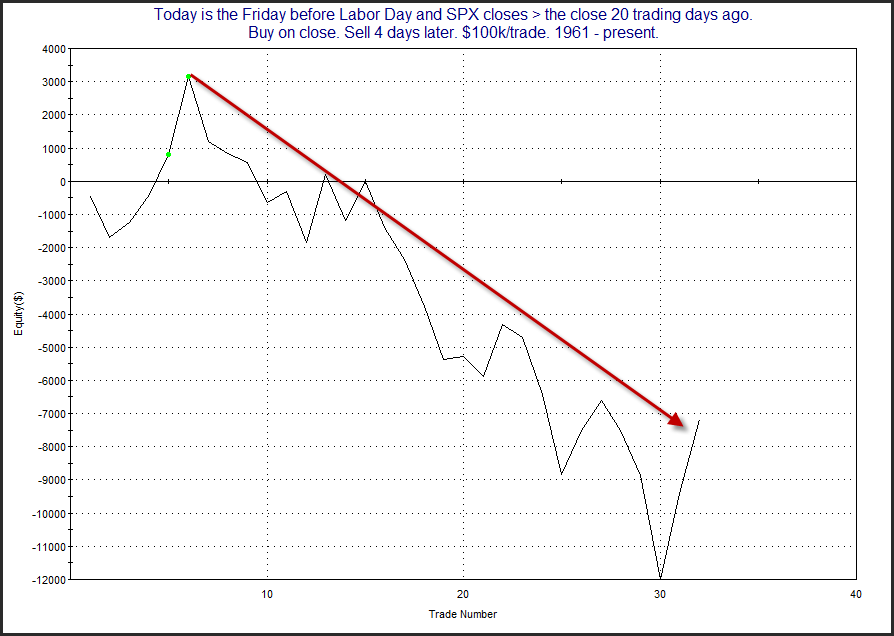

This shows the poor performance record when there has been a rise in the market. Below is a look at the profit curve using a 4-day exit strategy.

Definitely choppy. And the last couple of instances have seen gains during the week of Labor Day. But the overall downslope and evidence still has believing it is worth some consideration. (A strongly bullish performance this year could change my mind for the future, though.)

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.