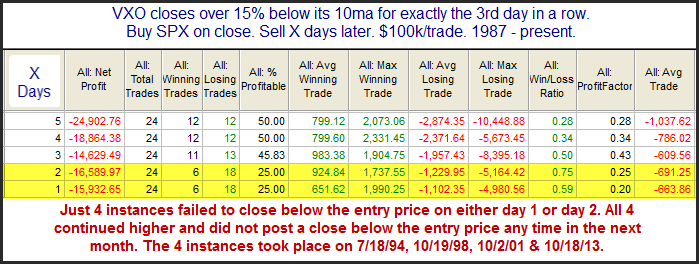

Both the VIX and the VXO have been extended to the downside in recent days. Such stretches suggest a collapse in fear among investors. The study below was last seen in the 12/27/13 blog. It looks for stretches of 15% or more that have persisted for three days.

Based on the stats table there appears to be a downside inclination. The note at the bottom of the study is especially interesting. Nearly every case has experienced an almost immediate pullback, but those that didn’t went without pulling back for a long time.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.