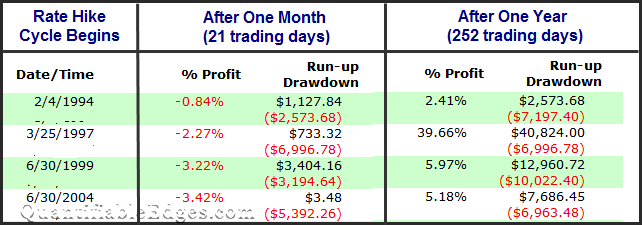

Fed announcing Wednesday that they will begin raising rates for the 1st time in 11 years. Since 1990 there have only been 4 other cycles of rate hikes. I decided to measure SPX performance from the start of those cycles. I found that one month later the stock market was trading lower every time. But one year later it was higher every time. Individual returns (based on $100k/trade) can be found in the table below.

Of course it is dangerous to draw conclusions from just 4 instances, but I thought it was interesting and somewhat noteworthy nonetheless.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.