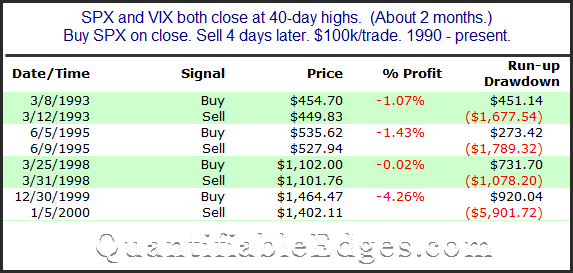

Wednesday saw both SPX and VIX close at 40-day highs (about 2 months). Since they commonly trade opposite each other, to have them both be extended up like this is very rare. In fact, it has only happened 4 other times. Below is a list of those instances along with their 4-day results.

The takeaway here is not that they all lost money over the next few days. Though that is notable, it would be dangerous to draw conclusions from just 4 instances. But I do think it is worth considering the fact there have only been 4 instances, and none since Y2K. The very low number of instances in itself demonstrates how unusual it is to have the SPX and the VIX pushing higher together. Current market conditions appear abnormal.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.