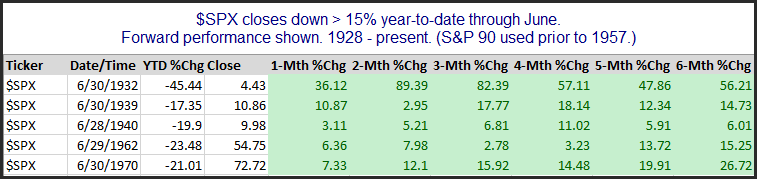

The market had a pretty awful 1st half of the year. The SPX lost over 20% through June, which is something it had not done since 1970 during the 1st 6th months of a year. Out of curiosity, I decided to see how other strongly negative 1st halves performed during the 2nd half of the year.

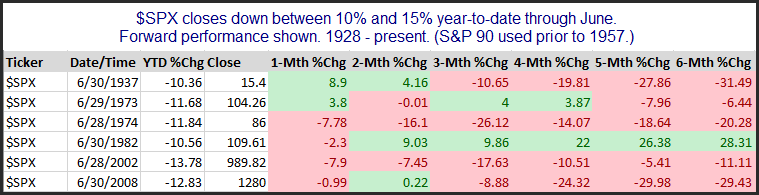

Those are some impressive 2nd half results. I will note that 1970 is the only one in the bunch that managed to close the year positive, and it only saw a gain of 0.1% at the end of the year. (Remember, a 20% drawdown needs a 25% rebound just to get back to even.) But before we get too excited about these results, let’s also look at instances that did not quite meet the 15% criteria, but were down at least 10% in the 1st half of the year.

Results here are much different, with 5 of the 6 instances posting losses in the 2nd half of the year. Of course, this year fits in with the 1st group, so perhaps we get a nice rebound. But instances are low and its been 52 years since the last instance. So I am not incorporating this into my bias at all. Still, I thought the results were interesting enough to share.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?