Market Performance In Relation To The 50 & 10-day MA’s

As I did with the 200/50 quadrant tests, I first broke the performance down by the number of points gained or lost from 1960 – present. (Click on any table or chart to enlarge.)

At first glance the numbers should look surprising. The most points gained have come following days where the market closed below both its 50 and 10-day moving average. Don’t bother thinking too hard about these numbers. They lie. The reason they are able to lie is that the results have changed dramatically from the 60’s and 70’s to the last 10 years (when the level of the S&P has been much higher). To illustrate this I will break down the performance using a set $100k/trade rather than S&P points. Below are equity curves broken down by quadrant as I did for the 200/50 a couple of weeks ago:

First let’s look at performance above both the 50 and 10-day moving average:

This chart is very similar to the same quadrant when looking at the 200/50 test. Good follow through was seen when the market was near its highs up until about 1988. From 1988-2000 the edge was weaker. Post 2000 is has been non-existent. Even the latest bull market from 2003-2007 failed to make much headway when trading above these two lines. I noted a few weeks ago that bull market saw little in the way of enthusiasm near highs and this is more proof of that.

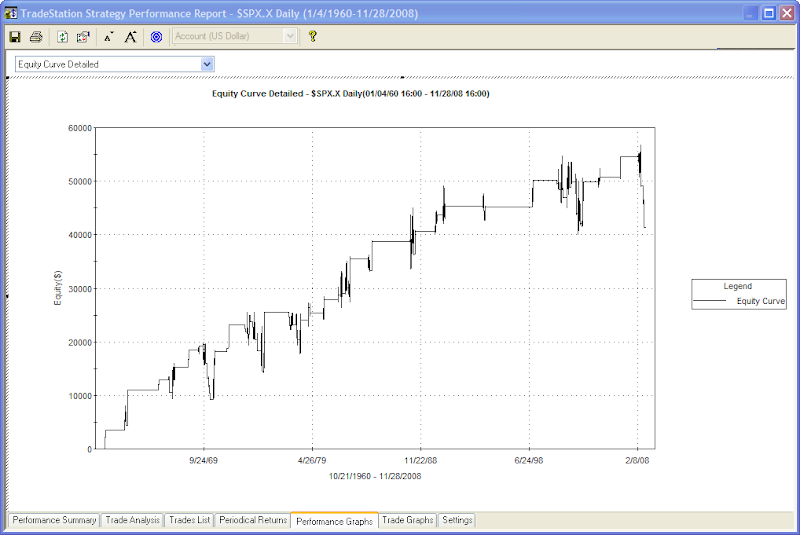

The next chart shows performance after the S&P closes above the 50 but below the 10-day moving average.

During the 60’s and 70’s this was not a place to be buying. Since the late 80’s this quadrant has generated some nice returns. The shape here is again somewhat reminiscent of the 200/50 chart of the same quadrant.

Now quadrant 3 – Similar to 2 weeks ago this is where the market has spent the least amount of time.

Again somewhat similar to the last test. This quandrant has done fairly well historically – mostly as the market emerges from below. The last two bear markets have seen some steep losses from this area, though.

A few quick observations to take from the above:

1) Whether using the longer 200/50 moving averages or the 50/10 moving averages the results look fairly similar.

2) It’s been a good 10 years since chasing strength worked and a good 20 since it’s worked well.

3) Pullbacks in uptrends have provided the best long-side opportunities over the last 20 years.

4) During vicious bear markets like the current one, buying below the 50-day moving average can be a difficult and dangerous endeavor. (See quadrants 3 & 4.)