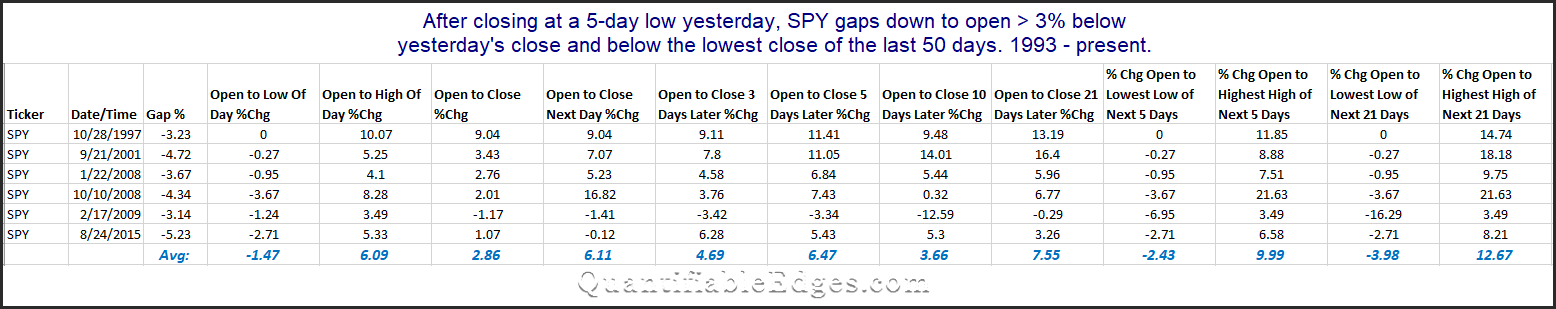

SPX futures are locked limit down 5% as I write this Sunday night. The small study below looks at all other times 1) SPY was already short-term oversold (closed at a 5-day low), and 2) gapped down at least 3%, and 3) opened below the lowest close of the previous 50 days. Below is the full list of instances along with performance following each:

A few notes:

- These numbers look pretty wonderful. Don’t get too excited.

- Performance only goes back to the inception of SPY. I did that because historical open/high/low prices for SPX are not accurate. Just closes. So measuring gap sizes and high/low levels is impossible. Hence the somewhat short history.

- There are only 6 instances. You generally do not want to make too much of just 6 instances. What this does do well is make the point that the market is acting far outside of normal.

- Not listed among these 6 instances is the 10/6/2008 instance, because that “only” gapped down 2.89% to start the day (just missing the 3% criteria). From the open that day to the low of the next 5 days, SPY lost as much as 22% intraday.

- Had SPY existed in 1987, Black Monday would almost certainly have qualified.

- It is tough to identify a high-probability play on a combination of forces unlike anything seen prior.

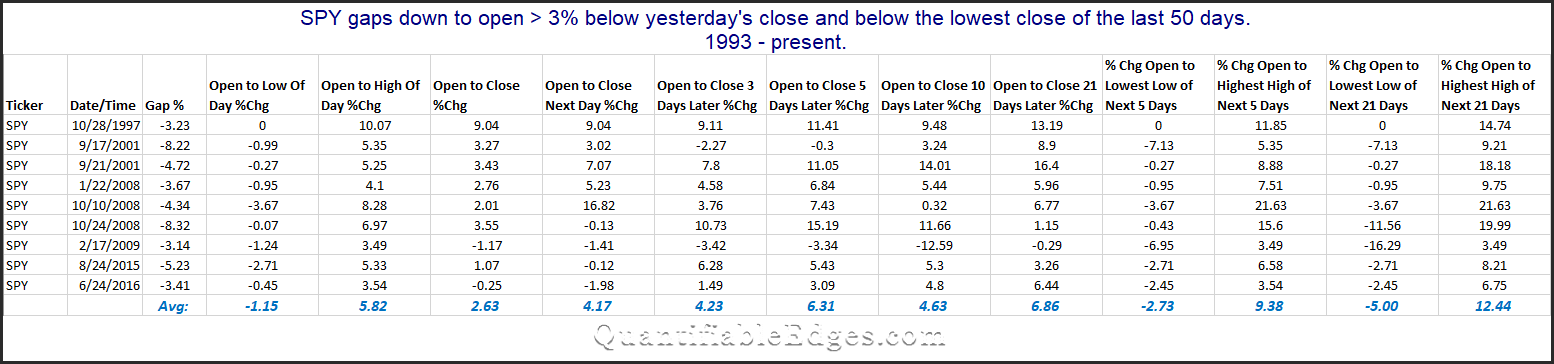

I also ran the study without the requirement that the day before closed at a 5-day low. There were a few more instances. Here is that table.

Good luck trading this week!

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.