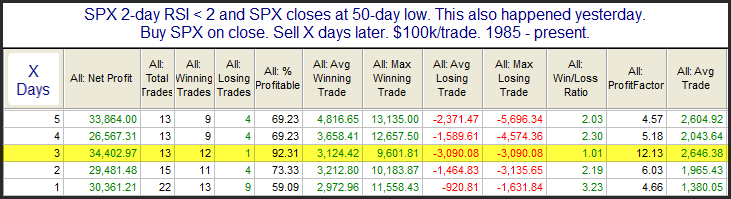

Strongly oversold markets often contain a short-term upside edge. Of course oversold can always become more oversold. Wednesday took the SPX down to a 50-day closing low. Additionally, many short-term price oscillators, like the RSI(2) showed extremely low readings. Further selling on Thursday meant another 50-day low and even lower readings. The study below appeared in the Quantifinder on Thursday afternoon. It looked at other times the SPX posted back-to-back 50-day lows and extremely low RSI(2) readings.

Instances are a little lower than I typically like, but the numbers are incredibly bullish and seem worth noting. I am seeing several studies right now all suggesting a bounce is highly likely in the next few days. This study is just one such example.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.