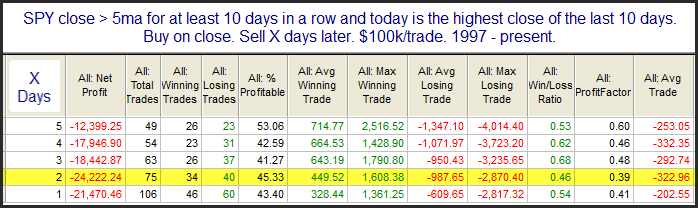

It has been a persistent move higher lately since the market bottomed mid-month. SPY has now gone 10 days without closing below its 5-day moving average (5ma), leaving it short-term overextended. The study below looks at other instances in which the market traded above the 5ma for at least 2 weeks and closed at a 10-day high.

In the past this setup has commonly been followed by a short-term pullback. The downside edge doesn’t last long, though. This seems to pretty much play itself out over the first 2 days. This study is one hint that the market is overdue for a bit of a pullback. As of last night I was still seeing more bullish evidence than bearish. With the big gap up this morning, it will be interesting to see whether a breakaway gap occurs and extends the rally further, or whether the short-term overbought nature of the market causes it to pull back as it often does.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.