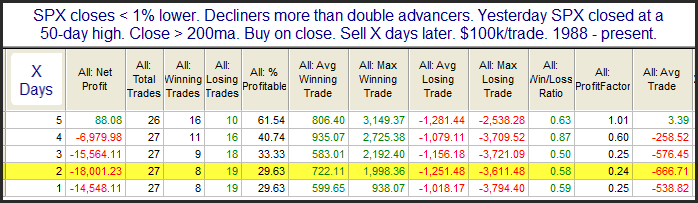

I am seeing a mix of evidence for both the short and long-term in recent days. The study below is one that triggered in the Quantifinder on Monday. It notes the fact that coming off an intermediate-term high on Friday, the selling Monday was broad but not extremely deep as measured by the SPX.

This type of broad selling will often see a deepening in the following days. Risks appear to far outweigh potential rewards when looking at metrics such as win/loss ratio and profit factor. The downside edge plays out quickly though, and has generally exhausted itself after the first couple of days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.