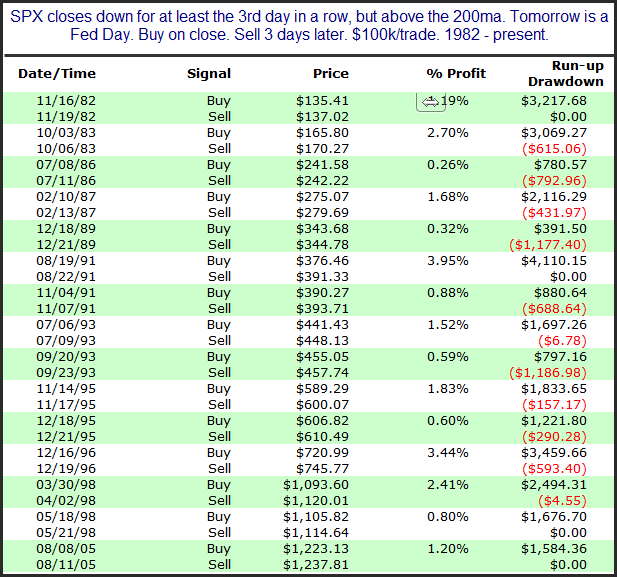

Tuesday’s decline was the 3rd down day in a row. Many people are now aware that Fed Days have historically had a bullish tilt. So 3-day selloffs leading up to Fed Days have been quite rare. But they have also been a very bullish setup. The table below shows the hypothetical results of buying at the close on the day before a Fed Day if it was at least the 3rd consecutive lower close. The exit is 3 days later.

All of the 15 instances saw the market higher 3 days later. These are some very encouraging numbers for the bulls. I do have a concern here. There has only been 1 instance in nearly 15 years. And that took place in 2005. The setup has certainly been potent over a long period of time. But I am much less enthused about it than I would be if all these instances would have taken place over the last 10 years. Still, with an undefeated record I think it is worth consideration.