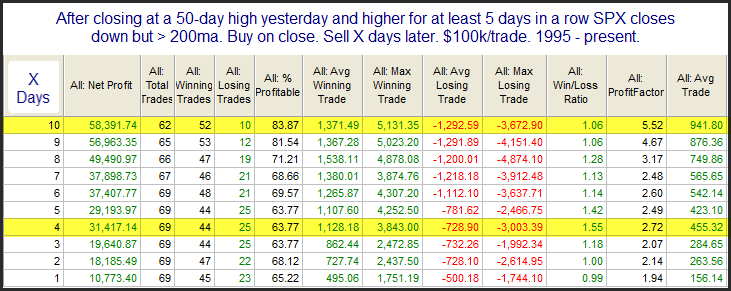

One compelling study from last night’s Quantifinder suggested the recent persistent upmove is unlikely to abruptly end. (This is a theme we have seen many times over the years.) It considers what happens after the market moves up at least 5 days in a row to a 50-day high, and then pulls back. I have updated the stats in the table below.

We see here a decent edge that becomes stronger and more consistent as you look out over the next several days. The 9-10 day time frame shows exceptional stats. Traders may want to keep this in mind over the next few days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.