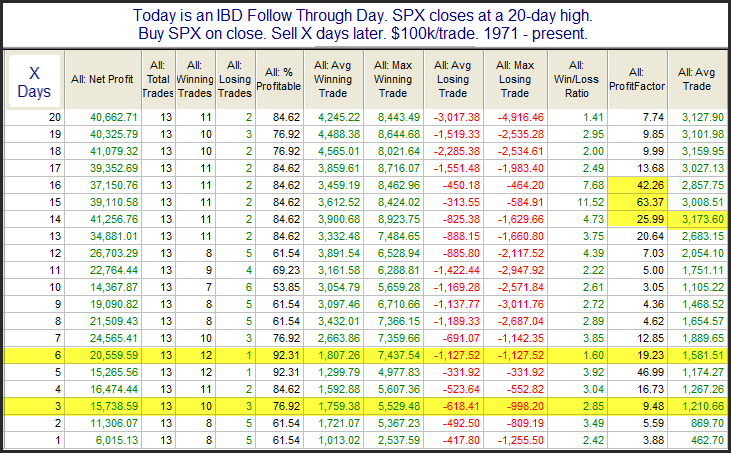

One notable bit of evidence that emerged on Wednesday was the fact that it qualified as an IBD Follow Through Day (FTD). I have done a lot of research on FTDs over the years. Much of that research can be found here on the blog. Unusual about this FTD is that it occurred in conjunction with SPX making a new 20-day high. This triggered the study below, which I last discussed in the 10/19/2011 blog.

Results here are impressive over both the short and intermediate-term. To get a better feel for the short-term returns I have listed the instances below.

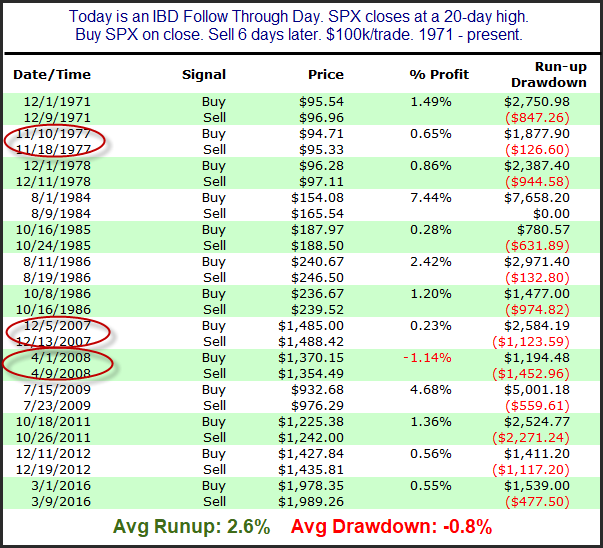

The run-up to drawdown ratio here is quite impressive. I’ll also note that 10 of the 13 instances went on to have “successful” rallies. (“Success” means it either hit a new 200-day high or at least rose 2x as much as it had already risen off the bottom.) The 3 instances whose rallies did not succeed (circled in red) all saw run-ups of at least 2% before they eventually rolled over and made new lows.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.