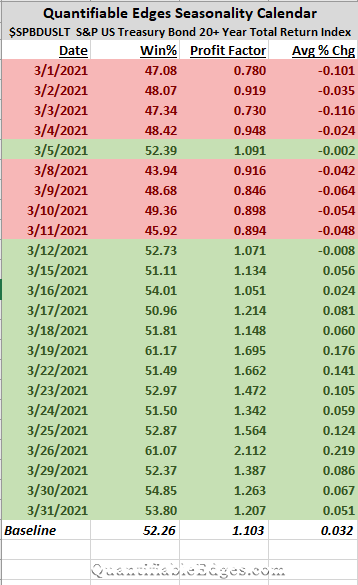

A couple of weeks ago I shared the March Seasonality Calendar for Long-Term Treasuries. I have copied it again below. I wondered whether the negative seasonality early in the month would even matter, since TLT appeared so strongly oversold at that point and perhaps due for some kind of bounce.

As of Friday morning, TLT is down nearly 5% on the month. (It is also down over 20% from its August closing highs – even including dividends.) So the oversold bounce did not materialize. But seasonality is now starting to turn positive. Numbers still appear somewhat muted for the next week, but starting on the 19th through the end of the month TLT should have a seasonal wind at its back to help with any rebound. Let’s see if it can mount one.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?