One notable bit of evidence that emerged on Tuesday was the fact that it qualified as an IBD Follow Through Day (FTD). I have done a lot of research on FTDs over the years. Much of that research can be found on the blog. Here is a link.

https://quantifiableedges.com/category/ibd-follow-through-day/

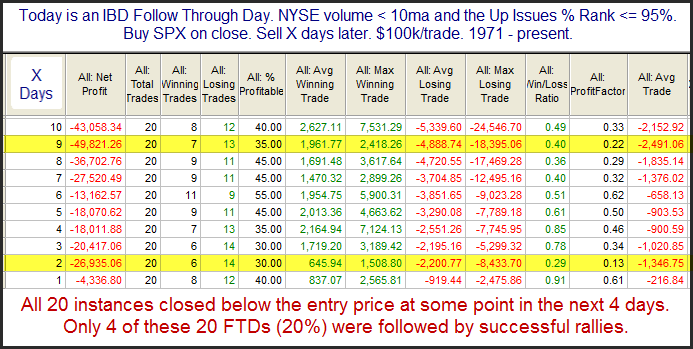

A couple of filters that have appeared useful in examining FTDs are breadth and volume. Tuesday’s FTD was accompanied by moderate breadth and volume. So let’s examine results of other instances with FTDs that occurred on modest breadth and modest volume.

The failure rate here is substantial no matter how you look at it. A short-term downside edge is suggested which largely plays out in the 1st 2 days. Every instance closed below the entry price over the next few days. And these FTDs have demonstrated a paltry 20% success rate. All these stats are impressive and point to a downside inclination over the next few days.

(Definitions for “successful” rallies as well as FTD determination criteria can be found in this post from 2008.)

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.