Over the last few weeks in the Quantifiable Edges Subscriber Letter I’ve posted a number of studies related to Fed POMO activity. I’m not the first to look at POMO. It is a topic I first saw on Zerohedge and have seen discussed many other places since. For those unaware POMO stands for Permanent Open Market Operations and it is how the Fed goes into the open market to buy (or sell) treasury securities. The net effect of this buying is an influx of cash into the system. It appears a portion of that cash makes its way through the banking system and into the stock market. It also appears that the net effect of all this Fed buying is a positive influence on the stock market. Conversely, when the Fed sells securities in the open market then it is pulling money from the system. This appears to have a possible negative influence on the stock market.

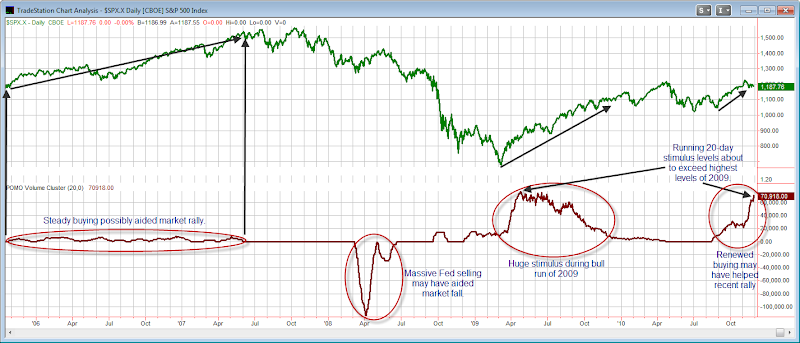

The chart below is of the S&P 500 since August of 2005 (as far back as the Fed’s POMO Database goes). The indicator on the bottom of the chart shows the total amount that the Fed either pumped into or withdrew from the system through POMO activity over the last month. (Running 20-day total par accepted.)

(CLICK CHART TO ENLARGE)

Note how the market has performed in accordance with past POMO activity. According to the Fed’s website, they are tentatively slated to perform buying every trading day from now through December 9th. Either Tuesday or Wednesday we should see the 20-day running total as shown on the bottom indicator exceed the highest levels in 2009. Based on the above chart, (and a number of studies I’ve conducted) it appears the old adage “Don’t fight the Fed” still holds true. If this is the case, then the Fed’s recent and scheduled activity should act as a bullish influence in the days and weeks to come.

![]()