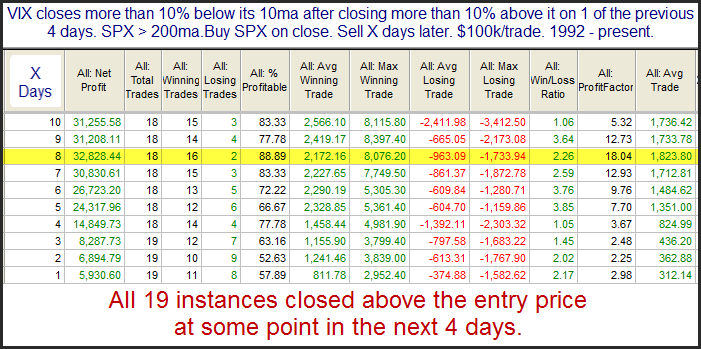

After a few strong days you will often find some bearish studies appearing. But the Quantifinder provided no bearish evidence yesterday afternoon. Just the bullish one below. It considers the sharp drop in the VIX over the last couple of days after a sharp rise the previous few.

The market condition that would typically accompany such VIX movement is one where you see SPX undergo a strong rebound from a sharp decline during a long-term uptrend, which is what we are currently looking at. Results over the first 2-3 days are not terribly consistent, but once you get out beyond that the bounce becomes more reliable and more powerful.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.