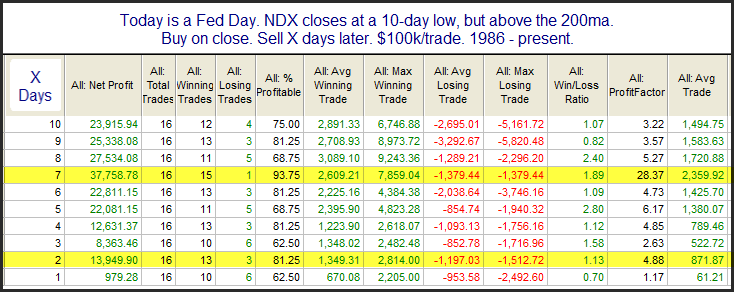

As far as Fed Days go, Wednesday was a disappointment. Not only did it fail to rally, but it also left SPX and NDX at 10-day lows. With Fed Days typically bullish, finishing at a 10-day low is quite unusual. The results table below is part of a larger examination I did in last night’s Subscriber Letter (click here for free trial). It looks at prior Fed Day instances of 10-day low closes for NDX when it was in a long-term uptrend.

The numbers are quite impressive, and point to a move higher over the next several days. The suggestion is that the Fed Day decline is often an overreaction, and that the market is likely to bounce. NDX looks like it is going to get off to a rough start on Thursday, so it is going to take a momentum shift if we are going to see historical odds play out this time. But seeing some additional selling is not unusual. Every one of the 16 instances saw a pullback of at least 0.6% from the entry price at some point over the next 7 days. I’ll also note that every instance saw a run-up of at least 0.8% over the next 7 days. And the lone loser after 7 days actually experienced a run-up of over 3% before turning down. This study, though limited in its scope, suggests the NDX is setting up for a bounce over the next several days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.