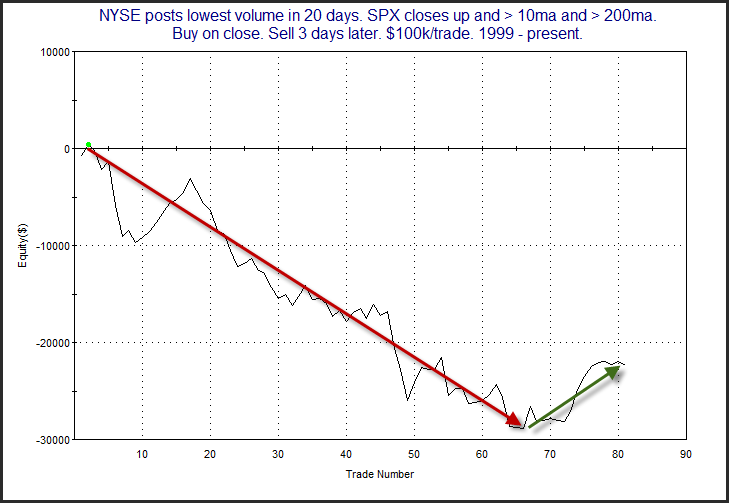

Light volume used to be a concern on a short-term basis. But light volume up days simply have not had the same bearish implications during the bull market of the last couple of years. The profit curve below is from an old study. It looks at light volume occurring when the market is above both a short and long-term moving average and closes up on the day. It exemplifies what I am talking about.

This curve bottomed about 15 instances ago on 2/29/12 (Happy Leap Day!). After exhibiting a consistent downside tendency for several years, dynamics appear to have changed. They could certainly change back. It could be something temporary causing this (like quantitative easing), or it could be something more permanent. I’ll continue to keep an eye on this setup in the future. But for the time being, it is something I no longer consider to carry bearish implications. And this is not an isolated study. I have seen numerous low-volume examples over the last several months.

Volume analysis is not the only thing that sees changes over time. Market “truths” are not static. They are dynamic. And traders need to pay attention as the market evolves.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.