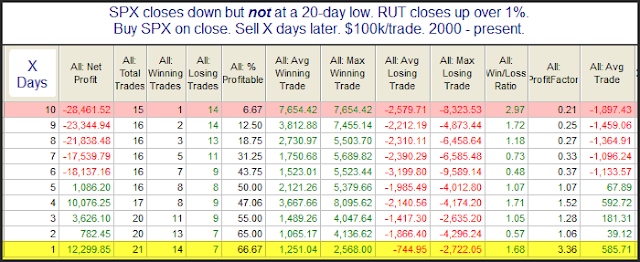

Last night in the Quantifiable Edges Subscriber Letter I examined short-term implications of strong 1-day rises in the Russell 2000 (RUT) while the S&P 500 (SPX) declined. I found that there appeared to be a decent upside inclination for the following day. This morning I played around with this concept a little further, added a filter that eliminated instances occurring in conjunction with intermediate-term lows, and ran the test out longer. What I found was quite interesting and can be seen in the stats table below.

While 1-day implications appear bullish, looking out over the next couple of weeks there has been a strong downward tendency. This may be worth keeping in mind over the next 10 days or so.