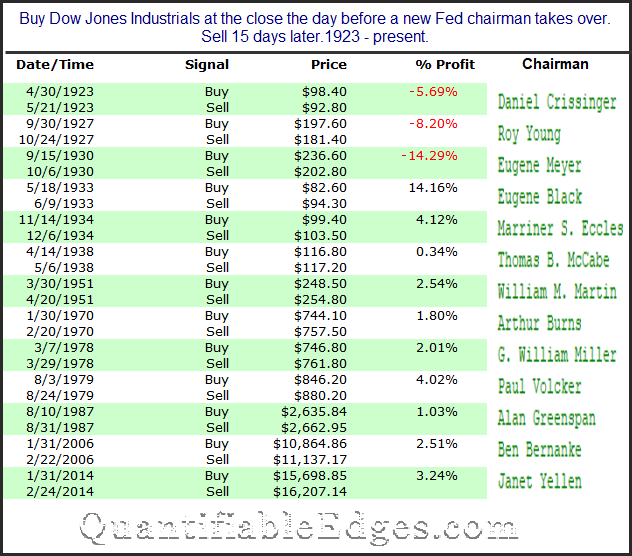

Jerome Powell is expected to take over for Janet Yellen as the new Fed chairman on Feb 3rd. A few days ago in the letter I looked at SPX performance after a new chairman takes over. I used the SPX and looked back to 1970. Tonight I decided to take the analysis back to 1923 using my Dow data. Like with the SPX, I found the first few weeks to be the most consistent and interesting data. Once we look out much further, the results become more mixed. So below is a list of past Fed chairman changes along with the 15-day performance of the Dow.

After 3 rough instances to begin the study, the rest of the chairman have been greeted with enthusiasm by the market in their early days. It did not always last. (Greenspan saw the crash of ’87 after just a few months on the job.) But if the last ten chairmen are any indication, the market rally may continue during February. Or if the market decides it really does not like Mr. Powell, then a Eugene Meyer nosedive would make for a tough few weeks. Personally, this was more an exercise in curiosity, than anything I plan to base a big trade on. Good luck Mr. Powell! We hope you are met with at least as much enthusiasm as Thomas McCabe was.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.