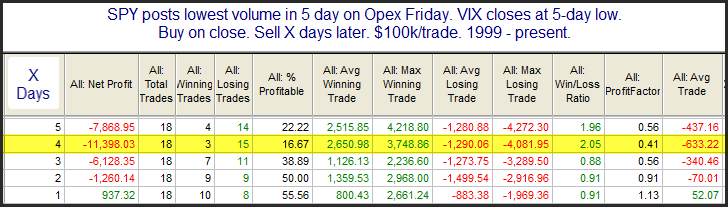

Despite the options expiration, SPY volume came in at the lowest level of the week. When combined with the fact that the VIX also closed at a recent low it brought about a bearish study from the Quantifinder. Results below are all updated.

The low VIX typically suggests complacency. It also frequently occurs when the market is at a short-term high level as it is now. The low SPY volume may also suggest complacency. SPY volume tends to spike during times of fear and to be low when traders are more comfortable. This is partially due to SPY often acting as a hedge security. Traders are less inclined to hedge when they are comfortable with market conditions. In any case, while the instances are a little low, the results are suggestive of a downside edge for about a week.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.