Over the last few months bond investors have been hit with the worst combination of rate moves. Intermediate and long-duration bonds have been rising rapidly while the very short-term rates have actually continued to decline. This can be seen in the charts below, which show the 30-yr Treasury Rate, 10-yr Treasury Rate, and the 13-Week Treasury Rate.

The rise in long rates has led to TLT (iShares 20-yr Treasury Bond ETF) losing over 20% from its 8/4/2020 closing high – that includes dividends paid over this time. A decline that large can be tough to make back when the current yield is just 2.1%.

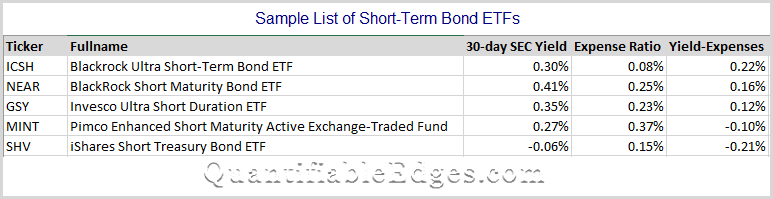

But the drop in rates on the short end has also been painful. Many short-term bond ETFs are struggling to keep their yield above their expense ratio. And the only way they are managing to do so is with a big chunk of their bond holdings in BBB or lower rated securities. Of course yields below expense ratios over an extended period means a negative return is likely in those assets. Below is a list of some of the more popular short-term bond ETFs along with their stated 30-day SEC yield and their expense ratios.

The Fed is not likely to remove pressure on short-term rates anytime soon. But right now it means bond investors are losing on the long end, and are even struggling to breakeven on the short end.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.

How about a free trial to the Quantifiable Edges Gold subscription?