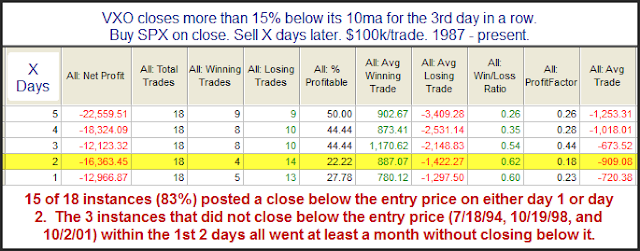

I continue to see a good mix of studies. The one below is bearish but I could also point to some bullish evidence that is perhaps just as compelling. Anyway, when the VXO has remained extremelely stretched for multiple days, it typically signals the SPX is about to pull back. You can see this in the study below, which triggered on Friday at the close, and could be found in the intraday Quantifinder prior to that.

I find the note at the bottom of the table to be especially interesting. It implies that the current setup provides a high probability of a quick pullback, but if that pullback doesn’t appear quickly that there is a good chance that the market will continue to power higher.