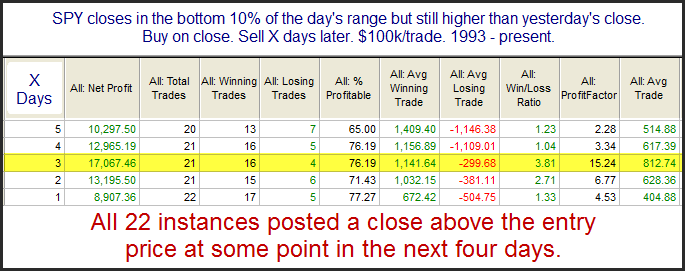

Yesterday’s late selloff was something that many chart readers might view as ugly on a chart. My research has shown quite the opposite. When SPY has closed near the bottom end of its range but still positive on the day that has generally been a good thing. Below is a simple study from last night’s Subscriber Letter that exemplifies this.

Even though the number of instances is near the low end of what I prefer the results are strongly suggestive of an upside edge. The profit factor and winning % are especially compelling.

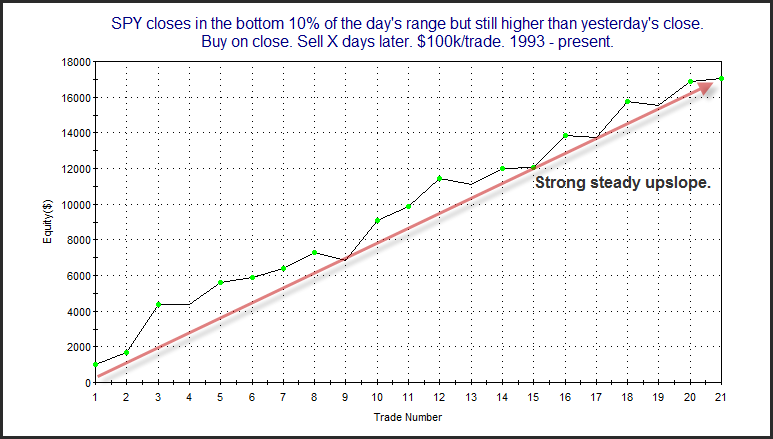

Below is an equity curve using a 3-day exit strategy.

Equity curves don’t get much straighter or more attractive than this. In one of my next few posts I’ll be discussing some of the things I look for in a study that make it compelling. This one has numerous compelling aspects and will act as a nice example.