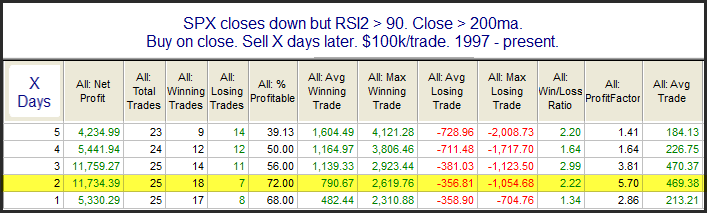

The move higher earlier this week pushed many oscillators strongly overbought short-term. With such a small SPX decline on Thursday, it is still very overbought as measured by the 2-day RSI. The 2-day RSI is a very sensitive indicator so it would take a very small decline from a very overbought position in order for it to remain above 90 on a down day. This is what happened on Thursday.

The stats here are all appealing over the 1-2 day period. Winning %, win/loss ratio, and profit factor all strongly favor the bulls. When an overbought market has pulled back as little as it did Thursday, it may not want to pullback at all, and has often continued higher over the next 1 to 2 days.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.