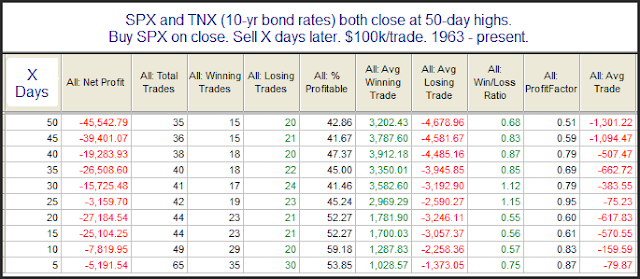

The fact that the 10-year bond rates hit new highs Friday along with the SPX is notable. The study below last appeared in the 12/9/10 subscriber letter. Stats are current.

Generally it seems that higher interest rates have often made bonds an attractive investment. This may lead people to forsake stocks in favor of lower risk returns with improved yield. Implications of this study appear to be longer-term in nature than we usually see. We are still not 50 days out from the 12/8/10 occurrence, but that one appears unlikely to finish in the red. Over the last two months more bullish forces have had their way. In last night’s letter I showed how this edge has been consistent since the late 60s / early 70s. I view this occurence as an intermediate-term warning sign.