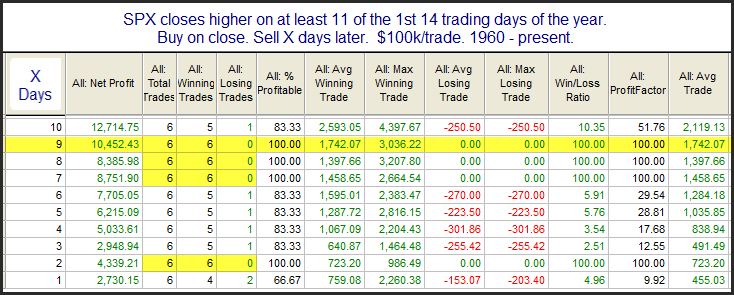

The start to 2018 has been fairly remarkable. The SPX has only closed down 3 days so far, while closing up 11 days. That is a substantial hot streak, and one might think that such a strong run to start the year would almost certainly have to pullback soon. So I checked.

The imminent pullback theory certainly does not seem to work here. All 6 previous instances were higher 2, 7, 8, and 9 days higher. And the worst loser over the 1-10 day period was only 0.3%. The kind of early-year strength we are currently seeing has always been followed by more upside in the past. The years where this occurred were: 1965, 1967, 1976, 1979, 1987, and 2012.

With just 6 previous instances, and only one in the past 30 years, this study does not get me enthused about jumping into a long position here. But it does make me a little more wary of trying to short into this strength.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.