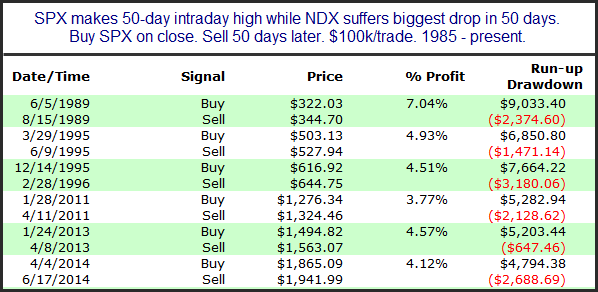

It was interesting that the new intraday high Wednesday for SPX came on a day when NDX had its worst day since August. The study below looks at other instances of a 50-day high for SPX and the biggest drop in 50-days for NDX.

Results are fairly impressive, and suggest a bullish edge based on limited instances. It is notable that every instance had a run-up of at least 4.8%, and the largest drawdown was under 3.2%. So yesterday’s SPX/NDX action appears to be potentially favorable for the intermediate-term.

Want research like this delivered directly to your inbox on a timely basis? Sign up for the Quantifiable Edges Email List.