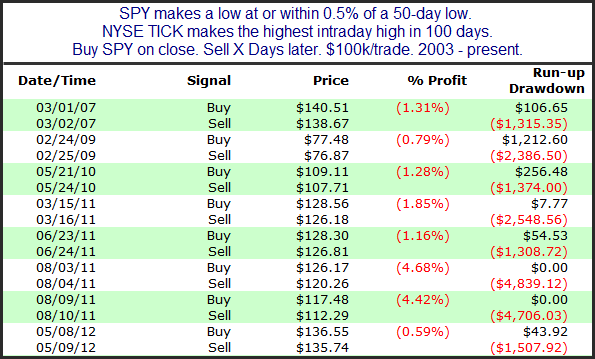

The rally near the end of the day Wednesday saw broad participation and aggressive buying. At one point the NYSE TICK spiked over 1500. It actually registered its highest intraday high since the end of August. I saw comments suggesting the very high TICK reading after a test of the lows was a good sign for the bulls. So I evaluated this concept. I formulated a test to simply seek out other instances where SPY probed or tested a new 50-day low while the NYSE TICK hit its highest intraday level in at least 100 days. The 1-day returns were the most interesting. I have listed all instances below.

The consistent and sizable weakness the next day has been very impressive. On average, the day following the extreme TICK near a market low has lost just over 2%. The average drawdown (2.5%) has been over 12 times the size of the average run-up (0.2%). It sure doesn’t look like the frantic intraday buying and high TICK is a positive.